Wd提问: Diversification

Ai批改: Diversification is a risk management strategy that involves spreading investments across different asset classes, sectors, or geographic regions to minimize risk and maximize returns、The goal of diversification is to create a portfolio that is not overly dependent on any one investment, thereby reducing the impact of any one investment's performance on the overall portfolio.

Benefits of Diversification:

1、Risk Reduction: By spreading investments across different assets, you can reduce the risk of significant losses if one investment performs poorly.

2、Increased Potential for Returns: Diversification can help you capture growth opportunities in different markets and sectors, potentially leading to higher returns over the long term.

3、Volatility Reduction: A diversified portfolio can help reduce volatility, as the performance of different investments can offset each other.

4、Improved Liquidity: A diversified portfolio can provide more flexibility and liquidity, as you can sell one investment to meet financial needs without having to liquidate your entire portfolio.

Types of Diversification:

1、Asset Allocation: Spreading investments across different asset classes, such as stocks, bonds, and real estate.

2、Sector Diversification: Investing in different sectors, such as technology, healthcare, and finance.

3、Geographic Diversification: Investing in companies or assets from different countries or regions.

4、Style Diversification: Investing in different investment styles, such as value, growth, and dividend investing.

Examples of Diversification:

1、Stock Portfolio: Investing in a mix of large-cap, mid-cap, and small-cap stocks, as well as stocks from different sectors and geographic regions.

2、Mutual Fund or ETF: Investing in a diversified mutual fund or exchange-traded fund (ETF) that tracks a broad market index, such as the S&P 500.

3、Real Estate Investment: Investing in real estate investment trusts (REITs) or real estate crowdfunding platforms to diversify a portfolio with real estate assets.

4、International Investing: Investing in international stocks, bonds, or funds to diversify a portfolio with assets from different countries.

Challenges of Diversification:

1、Over-Diversification: Spreading investments too thinly across different assets, which can lead to mediocre returns and increased complexity.

2、Under-Diversification: Failing to diversify enough, which can lead to excessive risk and potential losses.

3、Monitoring and Rebalancing: Regularly monitoring and rebalancing a diversified portfolio to ensure it remains aligned with investment goals and risk tolerance.

Best Practices for Diversification:

1、Set Clear Investment Goals: Determine your investment objectives, risk tolerance, and time horizon.

2、Assess Your Current Portfolio: Evaluate your current investments to identify areas of concentration and potential diversification opportunities.

3、Develop a Diversification Strategy: Create a plan to diversify your portfolio, considering asset allocation, sector, and geographic diversification.

4、Regularly Monitor and Rebalance: Periodically review your portfolio and rebalance it as needed to maintain your target asset allocation.

By following these best practices and understanding the benefits and challenges of diversification, investors can create a more balanced and resilient portfolio that is better equipped to weather market fluctuations and achieve long-term investment goals.

0

IP地址: 150.4.81.140

搜索次数: 54

提问时间: 2025-04-11 11:24:44

热门提问:

ai手机排行

国家黄金多少钱一克

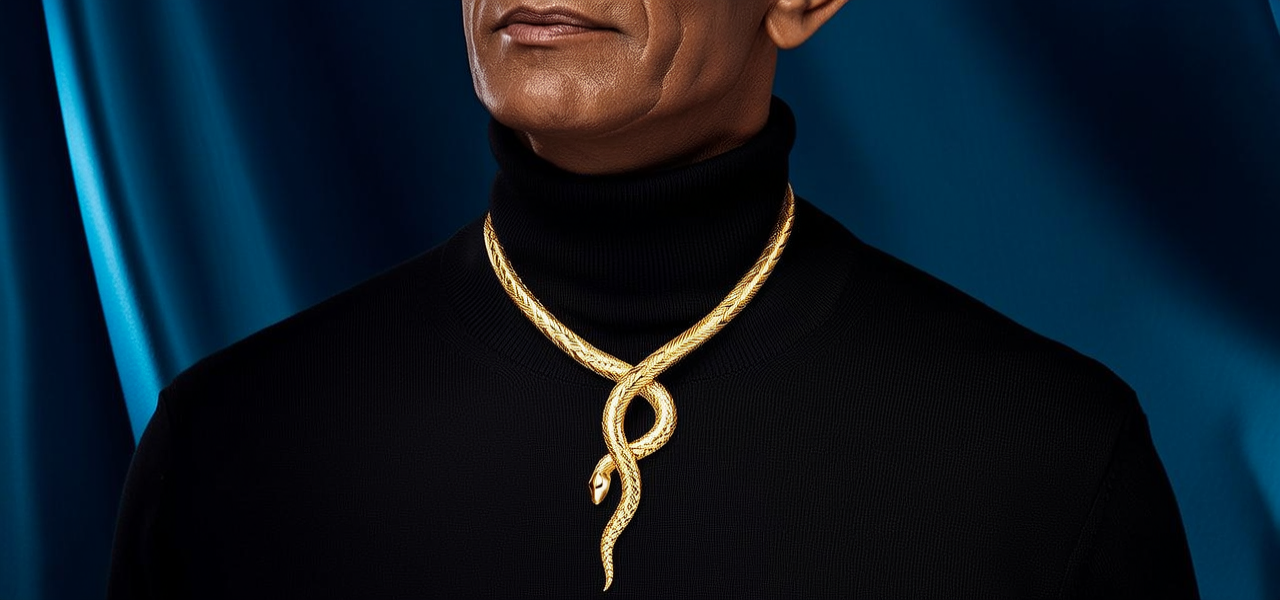

黄金项链如何清洗发亮

黄金网站18+

决定外汇汇率的基础是

二手黄金交易价格

2004国际金价

贵金属交易开户平台

去云南翡翠鉴定

亚洲黄金基金有限公司

豌豆Ai站群搜索引擎系统

关于我们:

三乐Ai

作文批改

英语分析

在线翻译

拍照识图

Ai提问

英语培训

本站流量

联系我们

温馨提示:本站所有问答由Ai自动创作,内容仅供参考,若有误差请用“联系”里面信息通知我们人工修改或删除。

技术支持:本站由豌豆Ai提供技术支持,使用的最新版:《豌豆Ai站群搜索引擎系统 V.25.05.20》搭建本站。