🗣 SL提问: 标普ETF

✍️ Ai批改: A popular investment option!

A Standard & Poor's (S&P) ETF, also known as a Standard & Poor's Exchange-Traded Fund, is an investment fund that tracks the performance of the S&P 500 Index, which is a stock market index that represents the market value of 500 large, publicly traded companies in the United States.

Here are some key points about S&P ETFs:

What is an S&P ETF?

An S&P ETF is a type of exchange-traded fund (ETF) that invests in the same stocks as the S&P 500 Index, in the same proportions as the index、This allows investors to buy or sell a single security that represents the entire index, rather than buying or selling individual stocks.

Benefits of S&P ETFs

1、Diversification: By investing in an S&P ETF, you gain exposure to 500 of the largest and most stable companies in the US, providing broad diversification and reducing individual stock risk.

2、Low costs: S&P ETFs typically have low expense ratios, making them a cost-effective way to invest in the US stock market.

3、Flexibility: S&P ETFs can be traded throughout the day, allowing investors to quickly respond to market changes.

4、Transparency: The holdings of an S&P ETF are disclosed daily, so investors can see exactly what they own.

Popular S&P ETFs

Some popular S&P ETFs include:

1、SPDR S&P 500 ETF Trust (SPY): One of the largest and most liquid ETFs, with over $300 billion in assets under management.

2、iShares Core S&P 500 ETF (IVV): A low-cost ETF with an expense ratio of 0.04%.

3、Vanguard S&P 500 ETF (VOO): A low-cost ETF with an expense ratio of 0.04.

Investment considerations

Before investing in an S&P ETF, consider the following:

1、Market risk: As with any stock market investment, there is a risk of losses if the market declines.

2、Tracking error: While S&P ETFs aim to track the performance of the S&P 500 Index, there may be slight differences in performance due to fees, trading costs, and other factors.

3、Tax implications: Investors may be subject to capital gains taxes if they sell their ETF shares for a profit.

Who is an S&P ETF suitable for?

S&P ETFs are suitable for:

1、Long-term investors: Those seeking long-term growth and willing to ride out market fluctuations.

2、Diversification seekers: Investors looking to add broad US stock market exposure to their portfolios.

3、Beginner investors: Those new to investing or looking for a simple, low-maintenance investment solution.

I hope this helps! Do you have any specific questions about S&P ETFs or would you like more information?

0

IP地址: 12.157.243.234

搜索次数: 259

提问时间: 2025-04-16 07:22:28

❓️ 热门提问:

介绍域名nuyf.cn的含义、价值与适合的行业。

外汇牌价如何看

555

ai剪切蒙版

ai做方案

如何通过ip知道域名

向谁申请域名

国联安鑫乾混合A

域名续费 哪家便宜

北京黄金回收最好的正规店

豌豆Ai站群搜索引擎系统

🤝 关于我们:

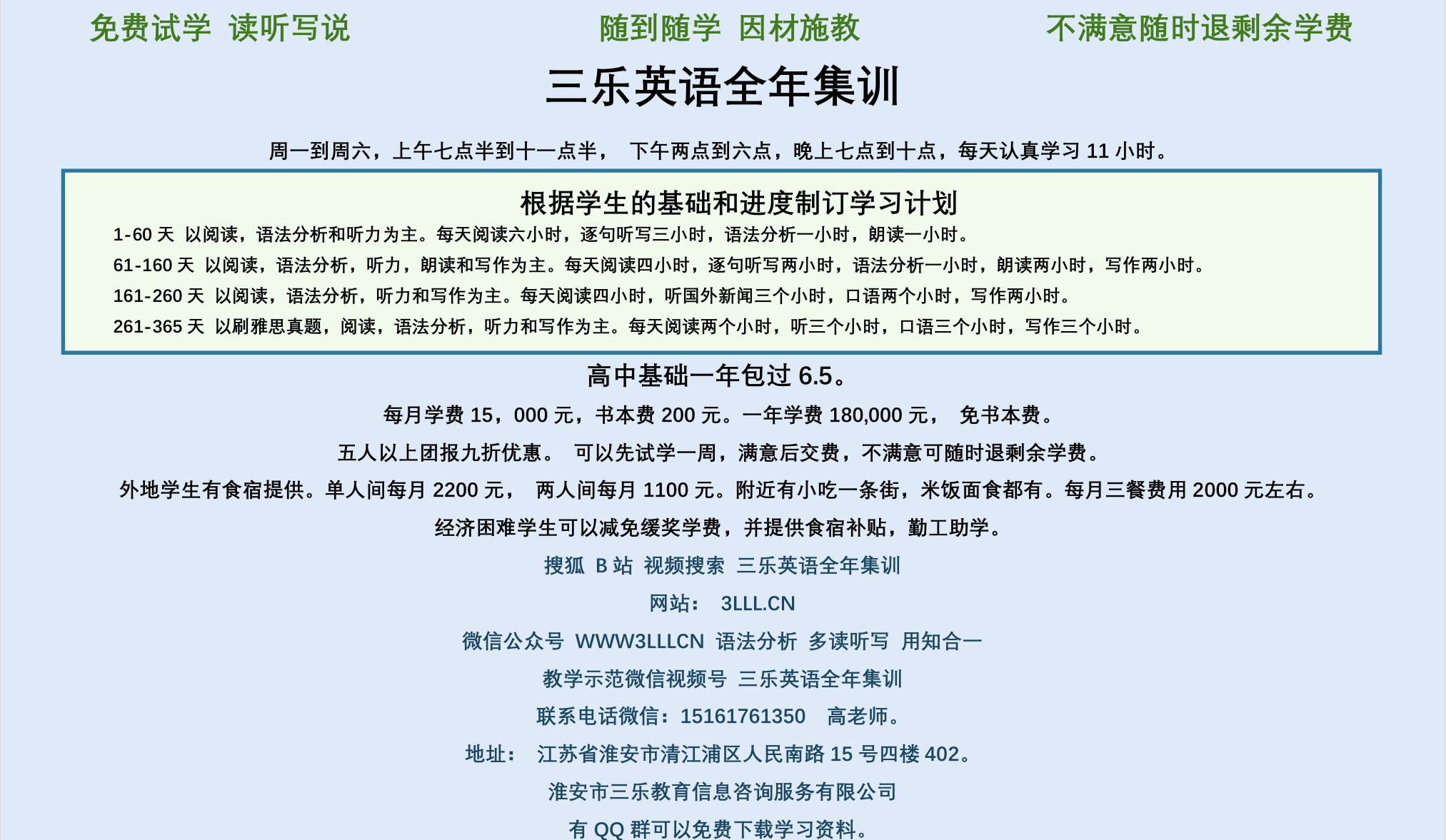

三乐Ai

作文批改

英语分析

在线翻译

拍照识图

Ai提问

英语培训

本站流量

联系我们

📢 温馨提示:本站所有问答由Ai自动创作,内容仅供参考,若有误差请用“联系”里面信息通知我们人工修改或删除。

👉 技术支持:本站由豌豆Ai提供技术支持,使用的最新版:《豌豆Ai站群搜索引擎系统 V.25.05.20》搭建本站。